Table of Contents

1. Understanding Global M2 Money Supply and Its Fluctuations

2. The Correlation Between M2 Money Supply and Bitcoin Price

3. Future Outlook and Investment Strategies

4. Conclusion

This article analyzes the intricate relationship between global M2 money supply and the price of Bitcoin,

providing crucial insights into

future investment strategies.

"How does the change in M2 money supply affect the price of Bitcoin?"

"What investment strategies should be adopted for safety?"

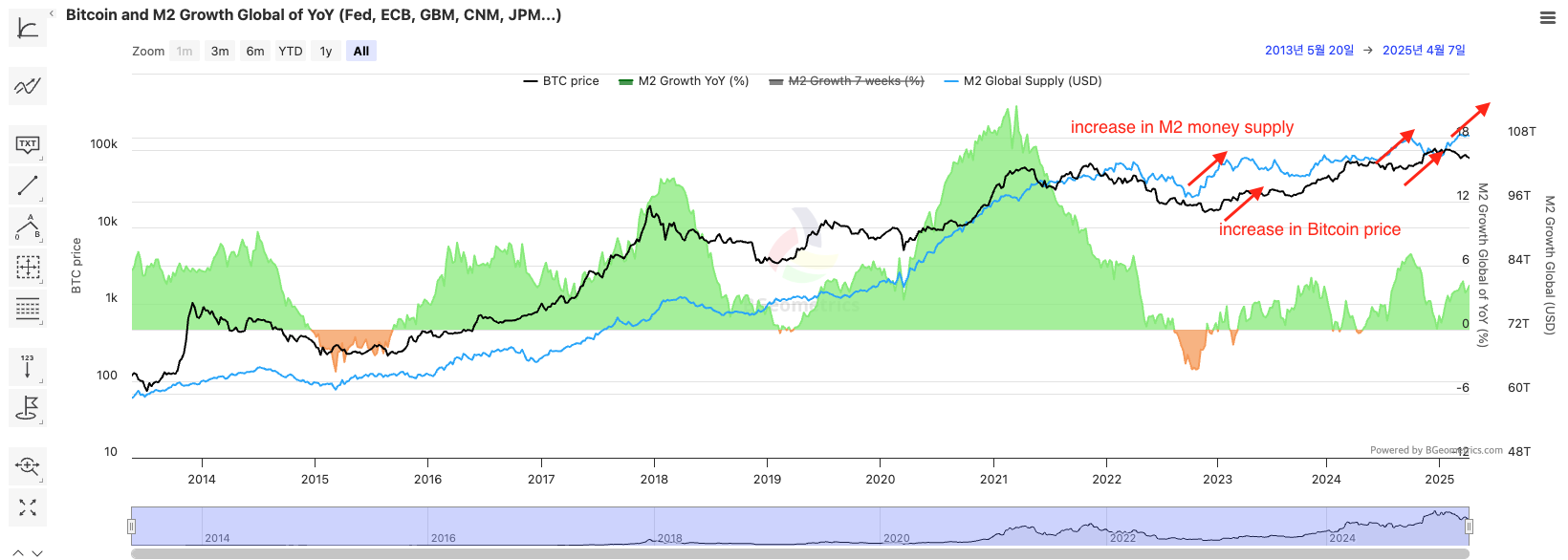

Global M2 money supply is a key factor influencing Bitcoin price volatility. A thorough analysis of M2 money supply changes and central bank policies is essential. "Historically, increases in M2 money supply have been a leading indicator of Bitcoin's rise. The recent upward trend in M2 money supply suggests a potential increase in Bitcoin's price."

1. Understanding Global M2 Money Supply and Its Fluctuations

M2 money supply is a broad measure of a nation's money supply that includes cash, checking deposits, savings deposits, and money market mutual funds. It is a crucial economic indicator representing the liquidity available in the market. Generally, an increase in M2 money supply indicates greater market liquidity, while a decrease signifies a contraction in liquidity.

The factors influencing global M2 money supply fluctuations include:

- Central Bank Monetary Policy: Interest rate hikes or quantitative tightening (QT) tend to slow down the M2 growth rate, while interest rate cuts or quantitative easing (QE) promote M2 growth.

- Government Fiscal Policy: Government stimulus packages and increased fiscal spending can increase the money supply, leading to M2 growth.

- Economic Growth Rate: Robust economic growth typically leads to increased credit creation and M2 expansion, whereas M2 growth tends to slow down during economic downturns.

Recently, major central banks such as the U.S. Federal Reserve (Fed), the European Central Bank (ECB), and the Bank of Japan (BOJ) have been raising interest rates to curb inflation, resulting in a slowdown in the M2 growth rate across the globe.

2. The Correlation Between M2 Money Supply and Bitcoin Price

Bitcoin, being a decentralized asset separate from the traditional fiat currency system, often exhibits movements contrary to the M2 money supply. Generally, Bitcoin prices tend to rise when M2 increases, and conversely, a slowdown in M2 growth can potentially lead to reduced liquidity in the Bitcoin market.

Looking at historical data, the correlation between the M2 growth rate and Bitcoin price shows the following patterns:

- 2020-2021: Following the COVID-19 pandemic, large-scale quantitative easing by the U.S. and global central banks led to a sharp increase in M2, and Bitcoin's price also reached all-time highs.

- 2022-2023: Interest rate hikes and quantitative tightening to combat inflation caused a slowdown in M2 growth, and Bitcoin's price declined.

- Post-2024: As major central banks show signs of easing their tightening policies, the M2 growth rate is recovering, and Bitcoin's price is also showing a recovery trend.

These trends suggest that Bitcoin tends to experience stronger upward momentum when global M2 money supply increases, leading to greater liquidity inflow into the market. Conversely, sustained tightening policies can exert downward pressure on Bitcoin's price.

3. Future Outlook and Investment Strategies

The global M2 money supply is expected to remain volatile depending on interest rate policies and economic growth. While major central banks are still focused on controlling inflation, signals of economic slowdown could lead to renewed liquidity provision.

For Bitcoin, future price movements will be determined by several key variables:

- U.S. Federal Reserve's Interest Rate Policy: Interest rate cuts could increase the M2 growth potential, which is positive for Bitcoin's price.

- Increased Bitcoin Holdings by Institutional Investors: As global asset management firms include Bitcoin in their portfolios, long-term upward potential exists.

- Regulatory Changes: Cryptocurrency regulation policies in various countries can significantly impact Bitcoin's price.

Investors should closely monitor changes in M2 money supply and central bank policies, and develop strategies that consider Bitcoin's long-term growth potential.

4. Conclusion

Global M2 money supply plays a significant role in Bitcoin's price fluctuations, with higher M2 growth rates generally correlating with increased upward potential for Bitcoin. Given the potential for changes in liquidity conditions based on the policies of major central banks, investors must carefully observe macroeconomic trends and formulate their strategies accordingly.

While Bitcoin operates independently of the traditional fiat currency system, it tends to show stronger upward movements in environments of expanding liquidity, such as during M2 growth. Therefore, continuous monitoring of global monetary policies and economic trends is crucial for investors in the cryptocurrency market.